Crisis Time?

Why a financial, political, and unrest crisis is becoming more likely.

Commercial Summary: The financial markets are beginning to panic over the British pound and Britain’s rapid borrowing. Labour ideology prevents them from addressing these economic questions. We are therefore highlighting Britain’s vulnerability to a major financial crisis in the coming months. Should this occur, it would likely trigger an early election, mass unrest, questions about the nationalisation of major industrial and infrastructure assets, and a collapse in the value of the pound. It will significantly harden the position of a likely Reform government on immigration, welfare, and de-regulation.

Economic questions

30-year GILT rates, that is, the interest rate that the government must pay to borrow over 30 years, have been near their 1998 highs since January 2025, and have been hovering under 5.7% for some weeks. As of this morning, they went above 5.7%. Simultaneously, American, German, French, and Japanese yields are also near historic highs.

What this reflects is a general loss in confidence by the markets in the ability of monetary and fiscal authorities to meet their welfare, military, and other spending obligations. It is a global issue, but this piece will focus on Britain.

Ideology and paralysis

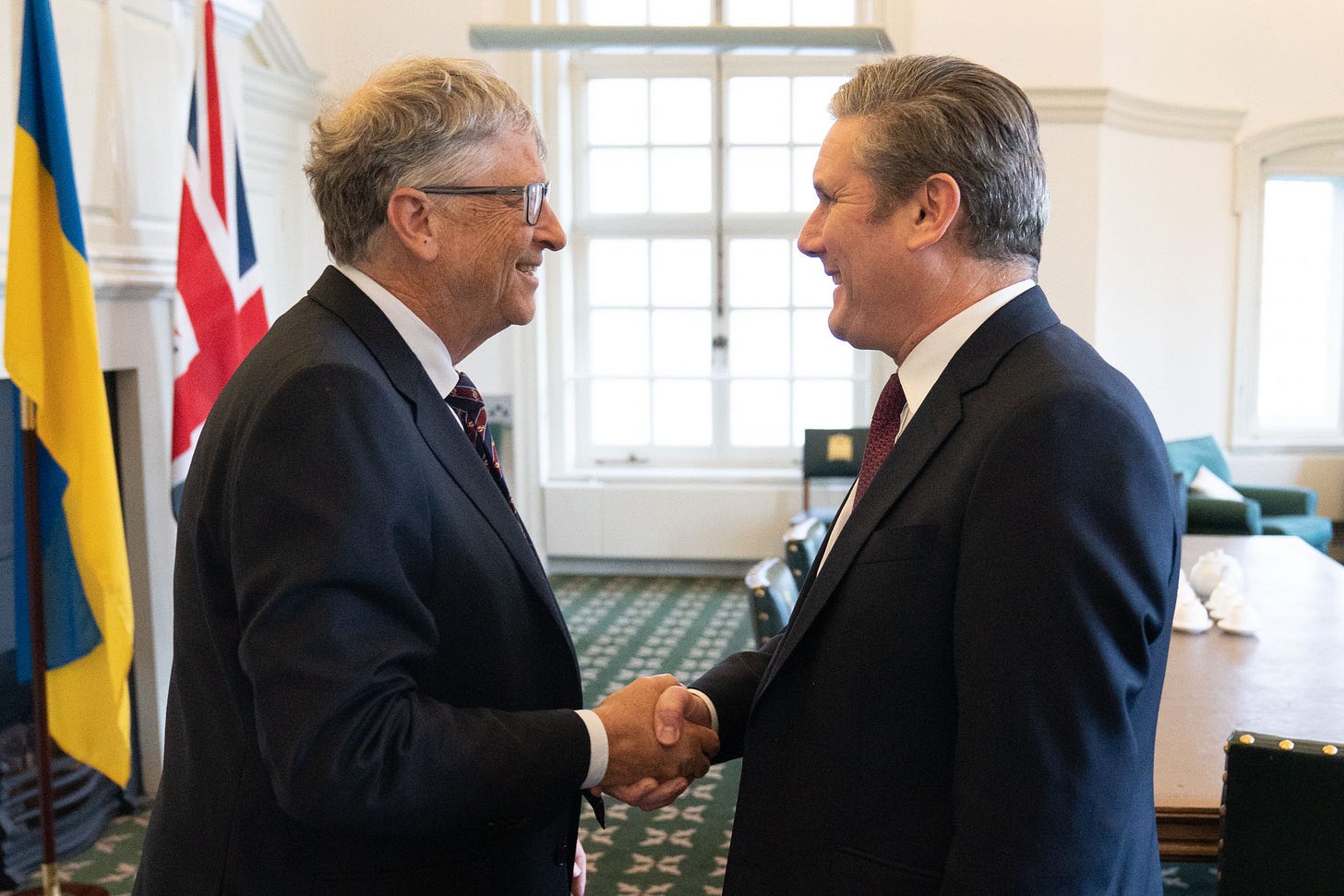

First, as we said when Sir Keir Starmer was elected Prime Minister, his government is far too ideological to manage spending sensibly. This was demonstrated in the government’s failure to introduce mild reductions in benefits, which led the backbenches of the Labour Party to revolt, forcing the PM to U-turn.

Second, Starmer and his Chancellor, Rachel Reeves, view budgets as an opportunity to settle scores with enemy classes. The targeting of landlords, hereditary peers, and farmers are not mere accidents or money grabs: they reflect a Communist-inspired worldview that seeks to separate property ownership from local identity. (Ms Reeves even has a photograph of a Communist Party of Great Britain founding member above her desk).

The result of all this is the continuation of the war on growth.

The political angle

Meanwhile, Elon Musk is campaigning against Sir Keir on X (formerly Twitter), and providing support to anti-government protesters and (credible) anti-government narratives around the predominantly Pakistani rape gangs, two-tier policing, extreme spending on illegal migrants, and the ongoing crackdown on free speech.

Musk, whatever the status of his personal relationship with Trump is, remains a uniquely positioned defence contractor, with deep ties to the American establishment. For example, the Ukrainians could not continue the war against Russia’s invasion without Musk’s Space X.

We therefore do not view Musk’s actions as those of a lone eccentric billionaire.

Moreover, we had mentioned that:

the American administration has long experience with colour revolutions inspired and motivated through social media; and that

American Treasury Secretary Scott Bessent is an expert in collapsing currencies and profiting from financial crises. His presence at Treasury may be intended to help bring down certain currencies to instigate political change. We also said that

the Americans are seeking to consolidate over their Western allies, as relations with China (and now India) are breaking down, as they adjust to a multipolar world.

Commercial Implications:

Our view is that there is a confluence of protests, American political actions, and economic factors that make Britain exceptionally vulnerable to a perfect storm that leads to a financial crisis, unrest, and probably early elections. We are expressing our view that this vulnerability exists, and that the likelihood of such a perfect storm is rising, without expressing a view on the timing.

Britain’s growth rate is slightly above the budget deficit - meaning that borrowing and migration the main drivers of growth, not any growth in capital or productivity or the native population. The economic and political model of Britain is fundamentally broken.

When Reeves and Starmer took office, they claimed to have found a £22 bn black hole in government finances. Now, with their expanded spending, and with higher taxes leading to lower tax revenues as they suffocate business, it is estimated that the shortfall in government finances is between £40bn and £50bn. This will obviously require much more borrowing and higher taxes.

Reeves will respond to this with much higher taxes - this will further stifle growth. Taxing your way into prosperity is impossible.