Trade War

Context and Likely Outcomes

Commercial Summary: The context for the trade war between America and China deserves a deeper dive, which we provide below, along with some commercial implications for investors. America is behind China in key technologies, and cannot afford to compromise or let up, except in a rather narrow way. The need to consolidate over Europe is greater than ever, but European leaders will resist this bitterly.

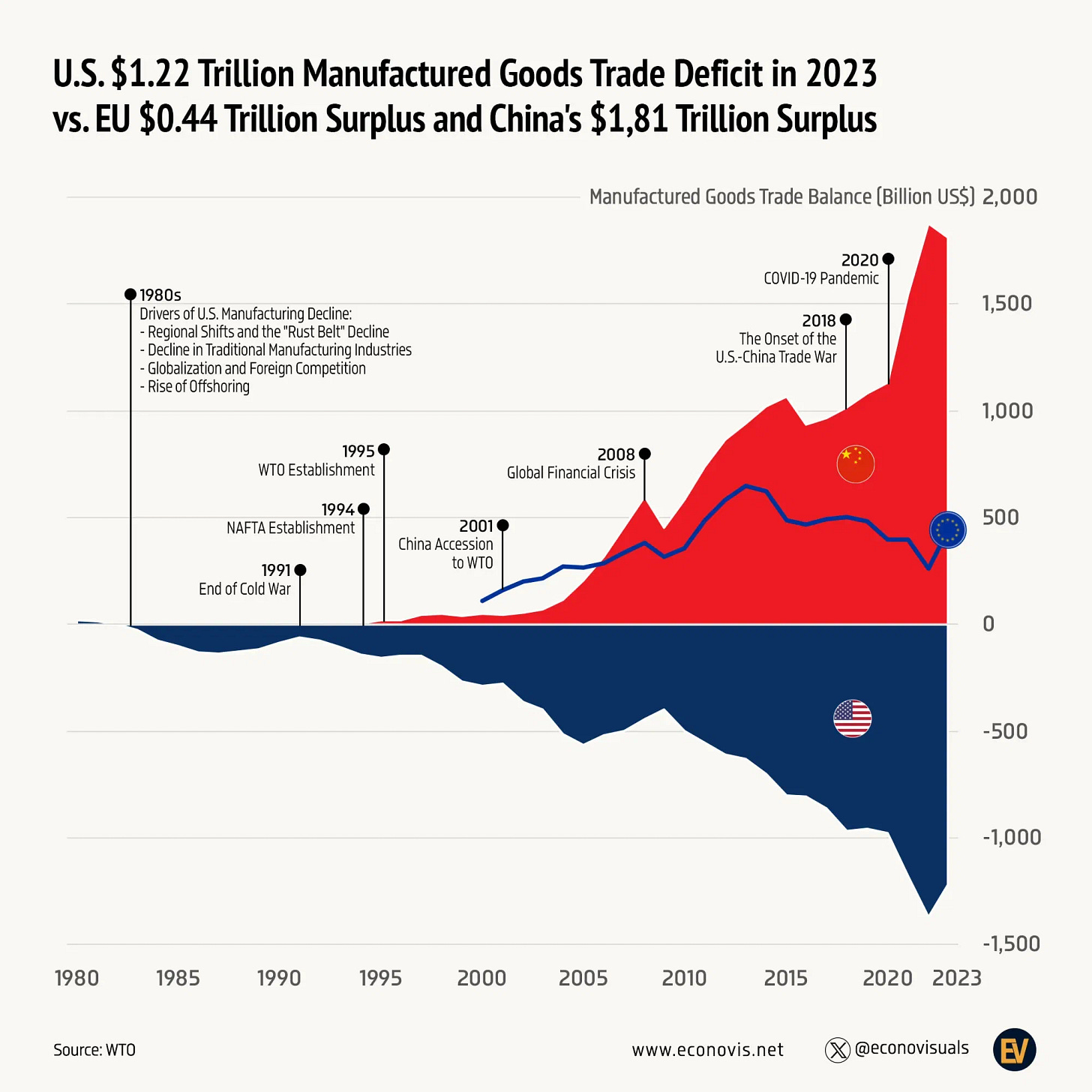

The Cold War ended with America having a large but acceptable deficit. This expanded throughout the 1990s as the North American Free Trade Agreement (NAFTA) came into effect. The trade deficit ballooned starting 2001, with China’s entry to the World Trade Organisation.

The result of the opening up to China has been that manufacturing value add flatlined in Europe, America, Japan, and South Korea, while it exploded in China.

It is worth recalling that China’s entry into the WTO was predicated on the assumption that trading with China would boost its middle class and turn it into a liberal democracy.

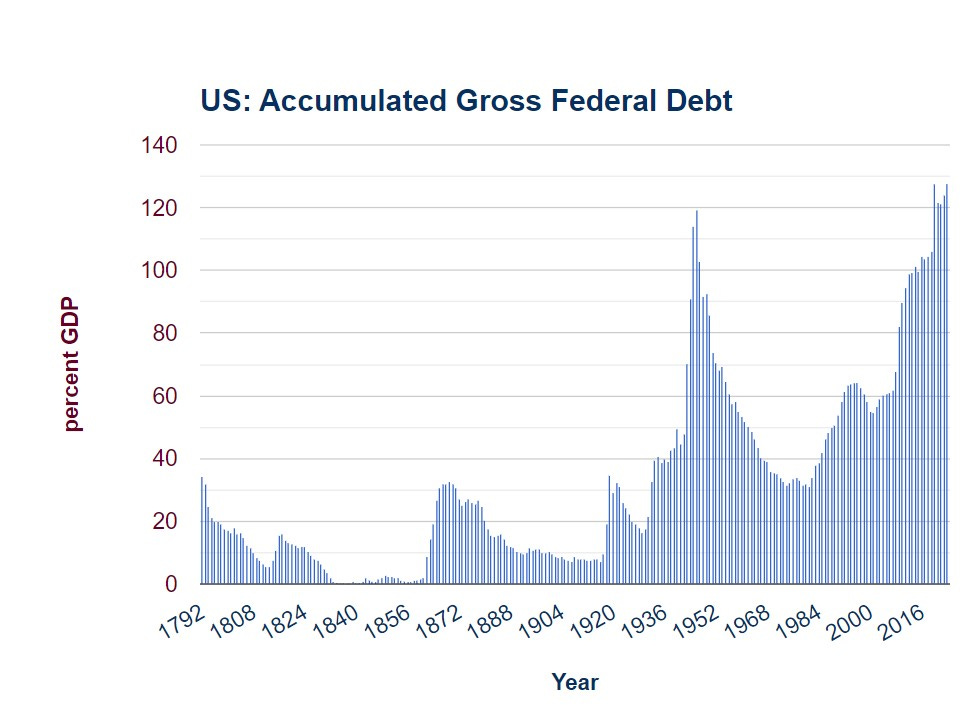

No country can indefinitely import more than it exports, unless it sells assets in exchange. The assets sold by America are primarily US Treasuries - that is, debt. The fiscal deficit props up the trade deficit.

Superpower competition

The impact on America’s role as a global superpower has been dramatic. Not only is China exporting almost as much as the EU and America combined.

China now can outbuild all other countries in the world in shipping. As the US’ claim to empire rests on its ability to police the seas, this is a dramatic development. Critically, the American shipbuilding capability is 14th in the world, with just 0.1% of gross tonnage built, below countries like the Philippines, Russia, Turkey, and Indonesia.