Trump's Economic Vision

Contextualising the tariffs.

Commercial audience: Supply chain managers, strategy teams, importers/exporters, trade credit insurers.

President Donald Trump is trying to live up to his campaign promise of America - and, therefore, Americans - First.

Economically, this involves the below pillars.

Reducing the fiscal deficit: Elon Musk’s DOGE department is trying to cut USD4 billion of annual spending PER DAY. This, if accomplished, will lead to around USD1 trillion reduction in the annual budget deficit. This is critical, given the astronomical growth of American national debt in recent years to 124% of GDP, and the unprecedented peacetime deficit of 6.2% of GDP.

Restricting illegal labour: the mass deportation of illegal migrants, and, perhaps more importantly, restricting the inflow of illegal migrants, helps raise wages for jobs that do not require college degrees. This is critical for poor and young Americans. For the youth, having entry level positions occupied by migrants reduces their ability to gain experience, setting back their careers. An ancillary benefit of reducing immigration is that demand for housing falls, or at least grows less rapidly, rendering it more affordable, raising living standards. Obviously, lower population growth rates also reduce the growth in demand for food, clothing, and other basics. Trump would hope that higher wages and reduced remittances would boost demand in other areas.

Increasing Americans’ labour market participation: Proposed legislation to cut benefits and impose work requirements to be eligible for benefits incentivises more workers to enter the labour market (at potentially higher wages due to the illegal workers’ expulsion). The administration is also taking executive action to restrict migrants’ access to welfare. Welfare for migrants allows them to accept lower wages than Americans who do not receive welfare. These policies are consistent with Americans First, though perhaps not with American corporations first.

Tax cuts: Trump is considering abolishing income tax for Americans on less than USD100k per annum. In America, 100k is considered middle class. Therefore, reducing income tax at this level will generate higher consumption, supporting growth. Trump also wants to extend and perhaps deepen the cuts introduced in the 2017 Tax Cuts and Jobs Act, which simplified filing taxes and reduced tax rates for corporations and individuals. He has spoken about a 15% corporate tax rate, which would be one of the lowest in the OECD.

Incentivising domestic production: With AI and automation transforming manufacturing, it makes sense for countries to seek to locate industries within their borders, as labour costs become less important. By making imports more expensive through tariffs, Trump can pressure companies to produce more within America, and to move their supply chains out of China, and, probably, the rest of Asia. This transition may require several years, up to a decade. The more certainty there is that tariffs are here to stay, the greater the incentive to relocate production to America. But this is by its very nature a slow process.

De-regulation: Rather than burden firms with compliance costs related to DEI and environmental requirements, Trump wants companies to just build and sell things. Globalisation was partly premised on transferring legal risks like toxic waste disposal, environmental impact, the treatment of labour, and other hot button issues abroad. Negotiating these issues as industry re-shore will be a critical question. Trump’s answer is to de-regulate and allow the market to navigate these issues.

Increasing manufacturers’ access to natural resources: Canada and Greenland are enormously resource rich. Increased American influence over them, whether by annexation, acquisition, or threats, will make it easier for American companies to grow. Moreover, by reducing environmental regulations in America, Trump can expand the extraction of natural resources in his country. If America can supply its own natural resources to companies that it is trying to convince to re-shore, this will positively impact growth, or so the administration likely believes.

Pressuring the Federal Reserve to lower interest rates: America needs to refinance USD7-9 trillion of debt this year. Reducing the interest rate expense, both by cutting the deficit to reduce the issuance of new debt, and by cutting the actual interest rates, would allow the US to issue new 10-year bonds on favourable terms. A crash in the stock market is therefore beneficial to the Trump administration, as it encourages the Fed to back the administration with interest rates.

Reducing energy prices: by working to reconcile with Russia, using the good offices of Saudi Arabia, Trump hopes that he can bring down energy prices. The pressure on Canada may force Canadians to boost their own energy production. The above, combined Trump’s domestic “drill, baby, drill” policies, may end up addressing one major source of inflationary pressure. However, the risk of war with Iran is a complicating factor.

Trump does things in a seemingly chaotic, boisterous manner. The media either attacks or defends him, and almost never analyses him.

Our view is that much of the above is mainstream policy aimed at reducing the government’s role in the economy, boosting labour participation, protecting domestic industry, raising wages, cutting waste, managing government finances wisely, and increasing growth. It is not unusual for domestic policy questions to be complicated by geopolitical considerations, as we also see from the above.

Historically speaking, free trade, free movement of labour, welfare for migrants, and high income taxes are the aberration. A far greater aberration is relying on a major geopolitical and cultural rival, like China, for manufactured goods, including steel, chemicals, medicines, and electronics, which are necessary for any country’s warfighting capabilities and therefore political autonomy. Trade in such fields is NOT an economic question. It is a question of sovereignty, with economic implications.

Commercial Impact

Correcting the historic anomalies of reliance on a rival like China, permitting excess illegal migration, and unprecedented welfare spending, will likely cause higher inflation in America as the trade war escalates and as wages climb. Our view is that this inflation will not be sticky in America if Trump gets lower energy prices and interest rates. In Europe, higher inflation seems far more likely.

The tariffs are negotiating tactic against some countries, but not all. The uncertainty serves Trump’s purpose of boosting American manufacturing.

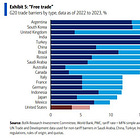

Trump is aiming to get to full free trade within the Western alliance, dismantling the barriers between the EU, Britain, Australia, New Zealand, Japan, South Korea, and the US.

Our view is that Europe and other Western American allies are not truly sovereign. They need American bailouts every time there is a global crisis, and American defence support every time there is a military threat. This will support Trump’s negotiating position.